Health Savings Accounts: Pros, Cons, and Retirement Considerations

What if your child needs braces? The cost may be as much as $6,000 for metal braces—more modern versions can run as much as $13,000. Your health insurance may cover only a portion of the cost. If you’re well past the braces stage, what if you or a loved one needs extended care, which almost 70% of those turning 65 today are expected to need at some point? Extended care can be costly, and private health insurance plans may not cover it. Fortunately, there is a way in which you can pay for some of these expenses using a tax-advantaged savings vehicle.1,2

What is a Health Saving Account?

In 2003, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act, which also created Health Savings Accounts (HSAs) as a tax-advantaged tool to help pay for medical expenses.

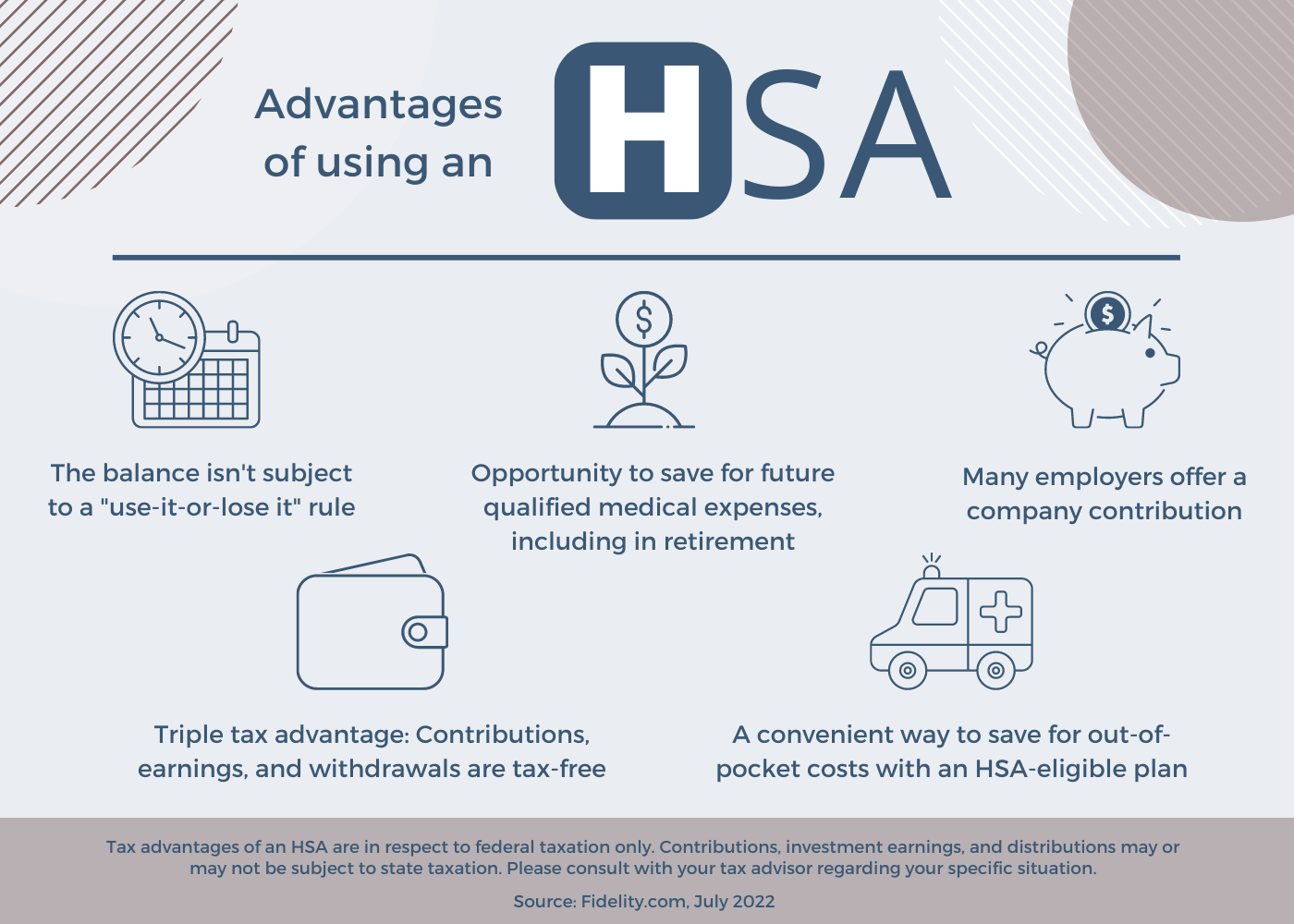

HSAs are designed to be used in conjunction with a high-deductible health plan (HDHP). If you purchase an HSA as part of your company’s benefits package, contributions are pretax, and withdrawals for qualified medical expenses are not taxable. Funds in HSAs can also be invested after your account balance reaches a certain limit, which the HSA administrator determines and which will vary.

Remember that if you spend your HSA funds on non-qualified expenses before age 65, you may be required to pay ordinary income tax and a 20% penalty. After age 65, you may be required to pay ordinary income tax on HSA funds used for non-qualified expenses. HSA contributions are exempt from federal income tax but are not exempt from state tax in certain states.

Fidelity.com, July 2022

If you spend your HSA funds on non-qualified expenses before age 65, you may be required to pay ordinary income tax as well as a 20% penalty. After age 65, you may be required to pay ordinary income taxes on HSA funds used for non-qualified expenses. HSA contributions are exempt from federal income tax; however, they are not exempt from state taxes in certain states.

Who Qualifies to Open an HSA

To qualify for an HSA contribution, you must meet the following requirements.

- You are covered under a high-deductible health plan (HDHP).

- You have no other health coverage.

- You aren’t enrolled in Medicare.

- You can’t be claimed as a dependent on someone else’s 2022 tax return.

IRS.gov, 2023

What is a High Deductible Health Plan (HDHP)?

HDHPs are just what the name implies. They are health plans with higher deductibles than other insurance plans. A deductible is the amount you must pay for healthcare services before your insurance starts to cover costs. With an HDHP, you typically have lower monthly premiums but pay more out of pocket for your healthcare costs before insurance coverage kicks in.

HDHPs were also designed to encourage individuals to be more cost-conscious about their healthcare spending because they are responsible for a larger portion of their medical expenses upfront. The idea is that having a higher deductible may encourage people to use healthcare services more judiciously.

With the uncertain outlook for healthcare costs, more people are turning to HDHPs. In fact, almost 56% of American private-sector workers were enrolled in HDHPs in 2021, the highest on record and the eighth-straight yearly increase. This means that more than half of these workers are eligible to use an HSA to help pay for medical expenses.3

Important Facts about HDHPs and HSAs

HealthCare.gov, 2023

Retirement Strategy Considerations of HSAs

Consider using an HSA as one savings vehicle for healthcare costs in retirement if you anticipate that your medical expenses may increase.

Unlike a Flexible Spending Account (FSA), which is funded with pretax dollars but must be used by a specific deadline, any money in an HSA that is not used in the current year can be used in the future. If your plan allows, funds in HSAs can also be invested after your account balance reaches a certain limit.

For some, an HSA is a way to prepare for future health expenses instead of anticipating that healthcare costs will be paid with other retirement assets. And unlike certain retirement plans, you are not required to take any funds out of your HSA, which can provide some versatility as you prepare for retirement income.

2023 IRS Contribution Limits and Deductibles

The Internal Revenue Service has released the 2023 cost-of-living-adjusted limits for HSAs and HDHPs. Here are the details:4

- HSA Contribution Limits. The 2023 annual HSA contribution limit is $3,850 for individuals with self-only HDHP coverage and $7,750 for individuals with family HDHP coverage.

- Individuals aged 55 or older can contribute an additional $1,000 as a catch-up contribution.

- HDHP Minimum Deductibles. The 2023 minimum annual deductible is $1,500 for self-only HDHP coverage and $3,000 for family HDHP coverage.

- HDHP Out-of-Pocket Maximums. The 2023 limit on out-of-pocket expenses (including deductibles, copayments, and coinsurance but not premiums) is $7,500 for self-only HDHP coverage and $15,000 for family HDHP coverage.

Pro Tip: Consider keeping detailed records of medical expenses and HSA withdrawals. If there is ever an issue, detailed records may help you address questions related to taxes and penalties.

Who Should, and Should Not, Consider an HSA?

Everyone has different life circumstances. This is especially true regarding health and the care you and your family need. While there are no hard and fast rules, here are some general guidelines for those who may and may not benefit from using an HSA.

- HSAs may be beneficial for individuals who:

- Are relatively healthy, with few medical expenses

- Believe they can afford a high-deductible health plan

- Are interested in preparing for healthcare expenses in retirement

- HSAs may not be the best choice for those who:

- Have chronic health conditions or high medical expenses

- May struggle to manage out-of-pocket costs associated with an HDHP

- Are already enrolled in Medicare

Spouses and Beneficiaries

Like a retirement account, you can name your spouse as the beneficiary of your HSA. In this case, if they outlive you, your spouse can keep the HSA in their own name and continue to use the funds for qualified medical expenses tax-free. While you can name others as beneficiaries, they may receive the funds as a lump distribution added to their income in the year received.5

The Pros and Cons of HSAs

There are benefits and drawbacks to opening an HSA, along with restrictions on who can use one. Since everyone has different personal circumstances, looking at the pros and cons of HSAs may help you decide whether to consider this approach to managing your healthcare dollars.

Making the best decision for you

HSAs are one tool to consider when preparing for healthcare costs, especially for people approaching retirement. As financial professionals, we may have some materials that can help you conduct a more in-depth evaluation of the pros and cons of HSAs. Healthcare is a key part of most families’ overall financial strategies, so it is critical to explore all your choices.

1 ConsumerAffairs.com, July 1, 2022

2 Administration for Community Living, 2023

3 ValuePenguin.com, January 30, 2023

4 Tax.ThomsonReuters.com, April 29, 2022

5 Forbes.com, 2023 (First published June 26, 2019)